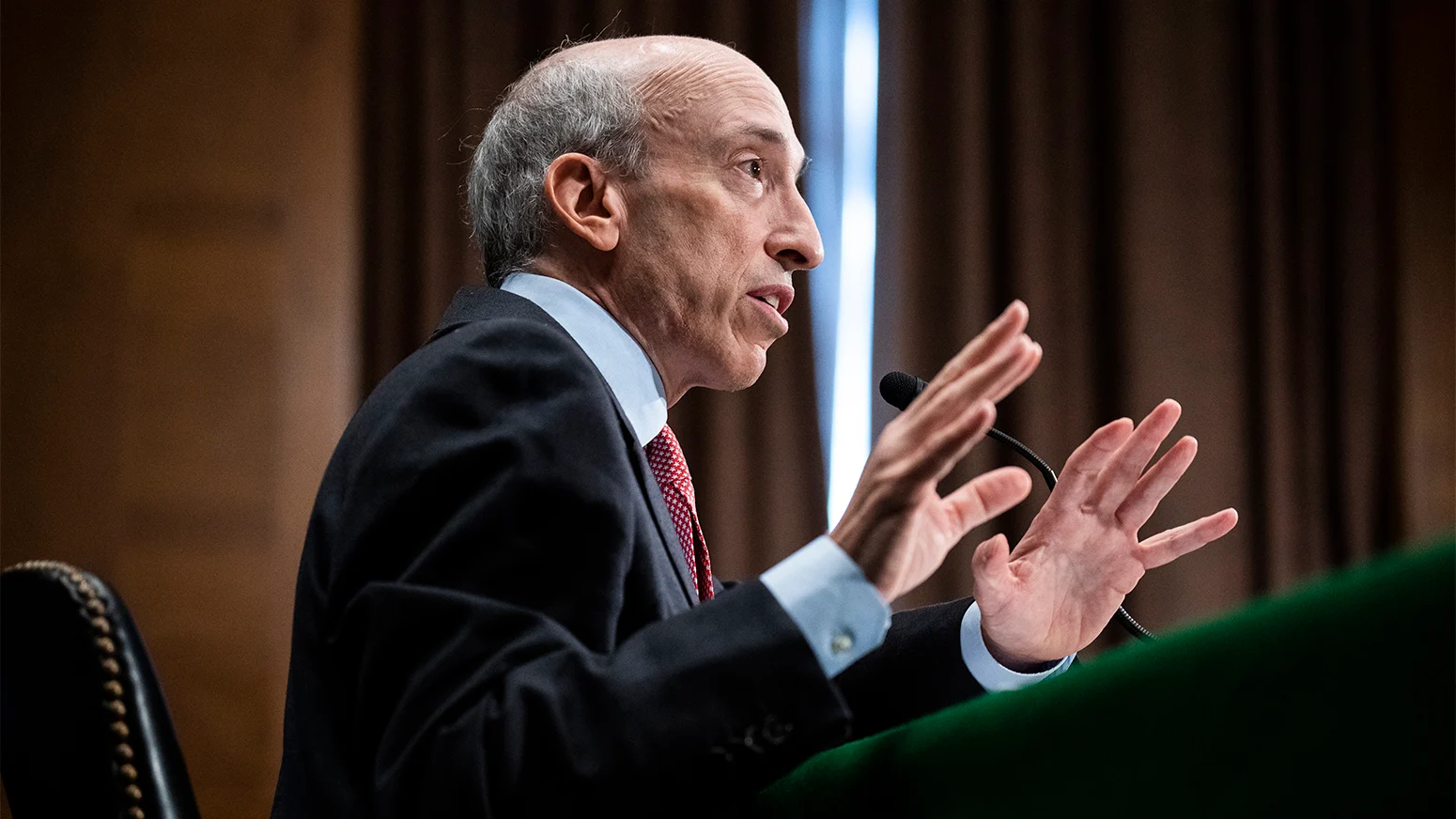

Gary Said Whaaat? (Part II)

Last time we looked at the first two prongs of the Howey Test and determined that while ETH cleared the first prong (investment of money), it was difficult to argue that a “common enterprise” exists within ETH because it is “sufficiently decentralized.”

Now we will take a look at the remaining two prongs of the Howey test: the expectation of profit.

The third prong of the Howey test is an expectation of profit.

I don’t think we need to spend time determining whether the average person buying ETH is expecting a profit. It could be that some institutions purchasing ETH (VISA/Mastercard) may be doing so to secure an asset (ETH) now that they anticipate needing it in the future (settling transactions in USDC on the ETH network for example). As a result, they may feel the need to purchase ETH to use it in the future and are not buying it with the intention of returning a profit, but for the purposes of this article, we are focusing on staking. Staking generates a return of 4% to 10% per year (paid in ETH), so it is difficult to argue that those participating in staking are NOT expecting a profit.

So that leaves the fourth prong of the Howey test: whether the profits from ETH staking are “derived from the efforts of others.”

In order to participate in PoS, you need to “spin up” your own node. You use a dedicated computer with certain minimum specifications (16-32GB of ram, 2TB SSD, decent processor). You then go through the effort of setting up the hardware with the software required to run the staking contract (Linux is the preferred OS, and people are less familiar with this system). Once your node is live, you need to make sure that it stays up and running properly and install updates as needed.

This is not a full-time job, but it does require effort to avoid slashing (penalization for downtime). To say that profits for solo staking are derived from the efforts of others would be disingenuous.

So solo-staking appears to require a decent amount of upkeep and would therefore fail to satisfy the fourth prong of The Howey Test.

But what about Staking as a Service?

CEXs like Coinbase and Kraken offer ETH staking for their customers without the need to lock up 32 ETH. In this case, users put up their ETH (generally a minimum of 1 ETH), which the exchange then stakes on their behalf. The CEX generally charges a commission or some other fee for this service.

In this case, the users of Coinbase and Kraken are relying on the efforts of these entities to realize a profit; however, Kraken and Coinbase are entities separate from the decentralized network itself that are being asked to perform a task (lock up and stake ETH) for a fee. The key distinction here is that neither of these entities controls or directs ETH so they are not affiliated with the asset itself.

Gensler’s arguments that Ethereum could be considered a security don’t stand up against the historical determination of whether it is an “investment contract” because ETH likely fails to satisfy two of the four prongs of the Howey Test.

TLDR;

ETH seems to fail two of the four prongs of the Howey Test. Unless the rules are rewritten, ETH is not likely a security.